New data shows the types of properties selling slowest and fastest

New data shows the types of properties selling slowest and fastest – Property Industry Eye

New data shows the types of properties selling slowest and fastest – Property Industry Eye

There was speculation that the Bank may raise the rate by as much as 0.75% – industry reacts to the news.

Bank of England raises interest rate by 0.5% to 2.25% – The Negotiator

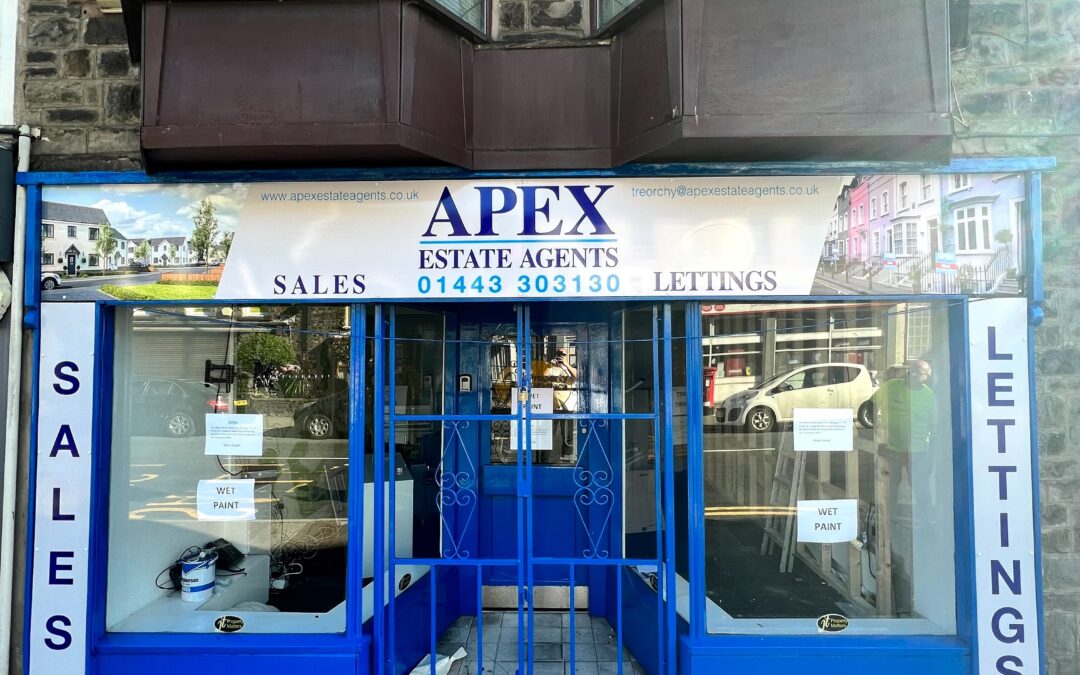

Rebranding begins at the latest Apex Estate Agents office in the pretty and picturesque village of Treorchy.

We have been awarded the highest grading available by Rent Smart Wales for compliance. We are now one of a few ‘Best Practice’ Agents. #topaward

Homeowners could soon be taking out 50-year mortgages to then be passed on to their children when they die, under new plans being considered by the government.

The Japanese-style lending agreements could see people being able to buy a home with little or no expectation of completing mortgage repayments during their lifetime.

Instead the property and outstanding debt would be passed on to their children.

Asked about the scheme, Prime Minister Boris Johnson said he was “certainly” considering cross-generation mortgages.

It comes as mortgage borrowing fell by 36% in April in another signal that the red-hot housing market is starting to lose momentum.

Recent Comments